Like every problem in life, to be able to fix it, you first need to understand it. When dealing with financial problems, this begins with understanding debt and being broke, as almost all financial issues stem from Bad Debt Management. Sometimes, you could have a good income, live in a nice house, but still be the walking definition of being broke.

“Please note that this post may contain affiliate links. This means that I may earn a commission if you make a purchase through those links at no extra cost to you. I only recommend products or services that I have personally used and believe will provide value to my readers. Your support through these links is greatly appreciated and helps me continue to provide valuable content. Thank you for your support!”

Why do we have debt?

We want things and we need things. Debt provides us with the opportunity to purchase those things we want or need before we have the money to pay for them.

So, What’s Debt?

Simply put, debt is money borrowed from someone else. In any form (written or verbal), it obligates the borrower to repay the amount borrowed by a specific date, along with the "cost of opportunity" for that money, or interest. In other words, Debt represents somebody else's passive income.

Another way to view debt, from the point of view of the borrower, is as money borrowed from your future income. Because with debt you will buy today something you actually can’t. So, your ability to pay a debt will depend on your ability to produce in the future.

History

History

Debt is one of the oldest inventions of civilization. In “The Debt Delusion: Evolution and Management of Financial Risk,” Will Slatyer notes its origins in the Babylonian Code of Hammurabi dating back to 1754 BC. Interest was only charged when the borrower did not repay what was borrowed.

Since its inception, the imprudence and excesses of creditors have caused several revolts and revolutions. Throughout history in places like Persia, Greece, Judah, and Rome, laws were established to help relieve debt obligations under certain conditions, especially those concerning usury and greed.

Debt is often misunderstood as inherently bad, when in reality, it can be beneficial if used wisely. Debt has played a pivotal role in shaping the economy. It has aided the industrial revolution and is vital for investments in businesses, homes, education, and unexpected medical expenses. While debt is essential for growth, education, and stability, excessive debt can bring about negative consequences.

Types of Debt

Debt can be broadly categorized as personal and commercial. Personal debt pertains to individuals’ financial obligations to banks, stores, or other individuals. Corporate or commercial debt is owed by legal entities with limited liability rights. The interest rates applied to these debts are influenced by factors like the borrower’s risk level, the type of product, or a combination of both.

Given the personal nature of this blog, we will focus more on personal debt. The most common forms of personal debt include credit cards, mortgages, personal loans, auto loans, and student loans.

Credit Cards

A credit card provides a predetermined spending limit that resets when the balance is paid. Interest rates are typically high because the lender primarily relies on the cardholder’s creditworthiness. Monthly minimum payments often prioritize paying the interest rather than the principal, leading to longer repayment terms and higher total payments. Also, it is usually compounded to be paid in 18 months*.

*Will vary depending on Bank’s policy

Another characteristics is that you will have a grace period to pay what you spend without any interest, that’s because you have a due date which is usually 25 days after the closing period.

Mortgages

Mortgages are used specifically for purchasing a house, with the property itself serving as collateral. Initial mortgage payments mostly cover interest, making early repayment of the principal beneficial to reduce interest payments over time.

Some banks in some countries will have restrictions or prepayment penalties.

Personal Loans

Personal loans are used to diverse personal needs such as medical expenses, debt consolidation, home improvements, or vacations. These loans may have fixed rates and terms based on collateral, creditworthiness, and disposable income.

An important “not to due advice” with personal loans is not to use it for things that do not last, like vacations. Mainly because vacations are a one-time thing, 15 days at the most, and you will still have to pay for it for at least 3 to 5 years. Believe me, at the end of year one you already want another vacation and will not probably have the ability to do it so.

Auto Loans

Auto loans, a subtype of personal loans, are secured by the vehicle purchased. Repayment terms are shorter due to the car’s depreciation compared to real estate.

Student Loans

Student loans support educational expenses and typically have deferment periods post-graduation. Various programs cater to undergraduates, graduates, medical students, and bar exam takers.

So now that you know that debt is money you use today that you actually don’t have, let me lay down some of the benefits and disadvantages of debt:

Benefits

- Assists in solving problems, fulfilling needs, and covering unexpected expenses.

- Used wisely, it can enhance the quality of life.

- Offers a sense of ownership, especially when used for significant purchases like a house or a car.

- Can be essential to change current circumstances and achieve goals.

- Responsible use of debt, such as mortgages and student loans, contributes to positive outcomes.

Disadvantages

- Excessive debt can reduce quality of life.

- It may lead to a sense of financial detachment and a cash flow crisis.

- Incur extra costs due to high-interest rates.

- Difficulty in meeting daily needs due to over-indebtedness.

- Poor repayment behavior can result in bad credit and higher interest rates.

In retrospective, most disadvantages of debt come from you doing something in excess or not controlling your spending habits. The drawbacks of debt often stem from poor financial management, such as late payments, over-borrowing, or neglecting future financial risks.

How we become broke?

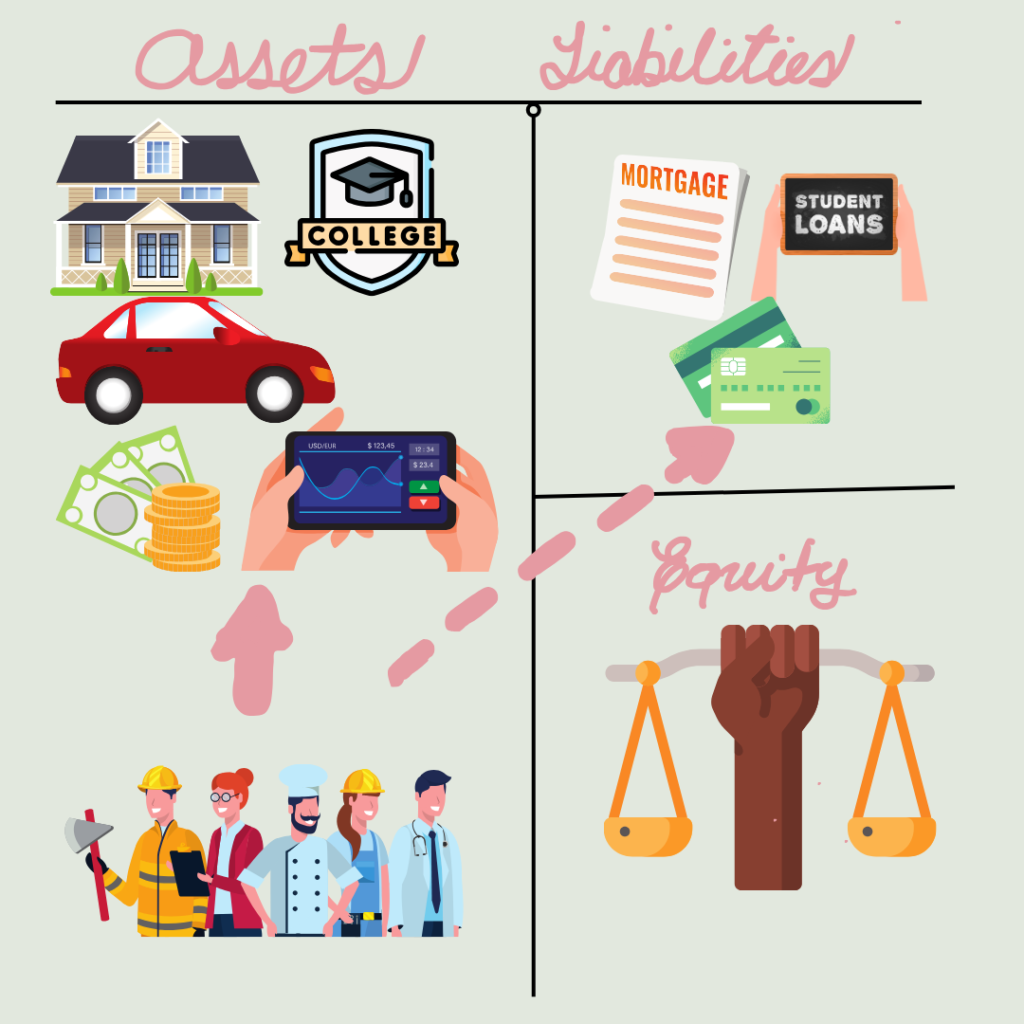

Being broke happens when liabilities (debt or excessive debt) outweigh assets, leading to negative net worth. This reinforces the importance of prudently managing personal loans that do not generate income. While banks may focus on your future earning potential, it is crucial not to jeopardize it by mismanaging debts today.

Everything we own and owed, should be analyzed in a financial statement structure

Personal Financial Statement

- everything we own, are our assets. For example, the market value of our house, car, our education and ability to find a job or generate income, etc.

- everything we owed, are our liabilities. Our mortgage, credit cards debt, personal loan debt, and so on.

- Our income (what our assets generate for us) pay our liabilities, purchase our assets and cover our expenses.

- The net value between the previous two (assets- liabilities) is our equity or capital. If this value is 0, we are break even. And, if this value is negative, then we are sadly broke.

Hence, we become broke when our liabilities (debt or too much debt) is higher than our assets. That’s why we have to be careful of all types of personal loans, that do not generate any type of income. Too much of this type of debt and it will compromise our assets and all the future income we generate.

Most Banks, will sell you the idea, on your future income. While, yes, you can and will generate income in the future. However, do not compromise it today and use debt wisely. How? Keep reading

Practical advices on avoiding being Broke

- Prioritize avoiding debt in everyday life if feasible. If you cannot afford something, refrain from purchasing it.

- Resist consumerist impulses and avoid unnecessary spending.

- Channel debt strategically by leveraging tax benefits through mortgages and investments.

- Utilize debt for income-generating investments in low-interest rate environments.

- Exercise caution with credit cards to prevent impulsive spending.

- When necessary, use personal loans wisely and prioritize repaying the principal.

Closing thoughts

I know, if you are not a financial girl or guy at all. All of these is too much information. Understanding debt and making sound financial decisions is the first step towards financial stability. If you have further inquiries regarding understanding debt and financial challenges, feel free to share.